Stock splits are significant events in the financial world, and when a major tech giant like Google (now Alphabet Inc.) announces a stock split, it grabs the attention of investors, analysts, and the media alike. A Google stock split is not just an event that affects stockholders; it has broader implications for market participation, stock price movement, and the overall health of the company.

In this article, we’ll cover everything you need to know about the Google stock split, including its history, reasons for splitting, its impact on investors, and frequently asked questions.

What Is a Stock Split?

A stock split occurs when a company increases the number of its outstanding shares while reducing the price of each share. This does not change the overall value of the company; it simply adjusts the number of shares that investors hold. Stock splits typically come in ratios such as 2-for-1 or 10-for-1, meaning that for every share an investor holds, they receive additional shares.

For example, in a 2-for-1 stock split, an investor who holds one share at $100 would receive two shares, each worth $50, post-split. The total value remains $100, but the investor now owns two shares instead of one.

Types of Stock Splits

There are two types of stock splits:

- Forward Stock Split: This is the most common type of stock split, where the company increases the number of shares and reduces the price proportionally.

- Reverse Stock Split: This is less common and typically happens when a company wants to increase its share price by reducing the number of outstanding shares.

History of Google Stock Splits

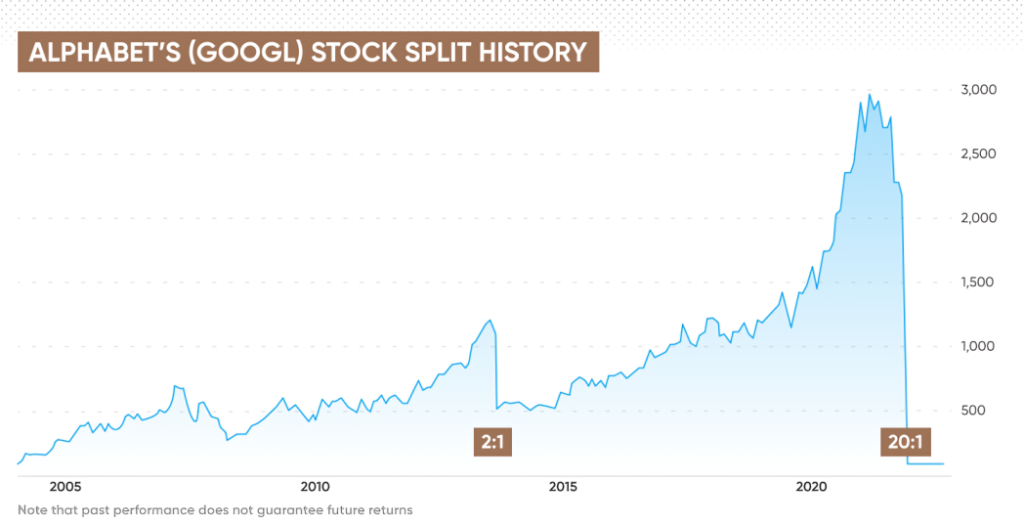

Google, now known as Alphabet Inc., has had a couple of notable stock splits in its history. These splits were designed to increase liquidity and make shares more accessible to smaller investors, without affecting the overall market capitalization.

2014 Google Stock Split (2-for-1 Split)

In 2014, Google announced its first-ever stock split, a 2-for-1 split. The split was slightly unconventional because it created two classes of shares: Class A (GOOGL) and Class C (GOOG). Class A shares are voting shares, while Class C shares do not come with voting rights. This split allowed the company to retain control by its founders, Larry Page and Sergey Brin, while still allowing investors to benefit from the growing stock price.

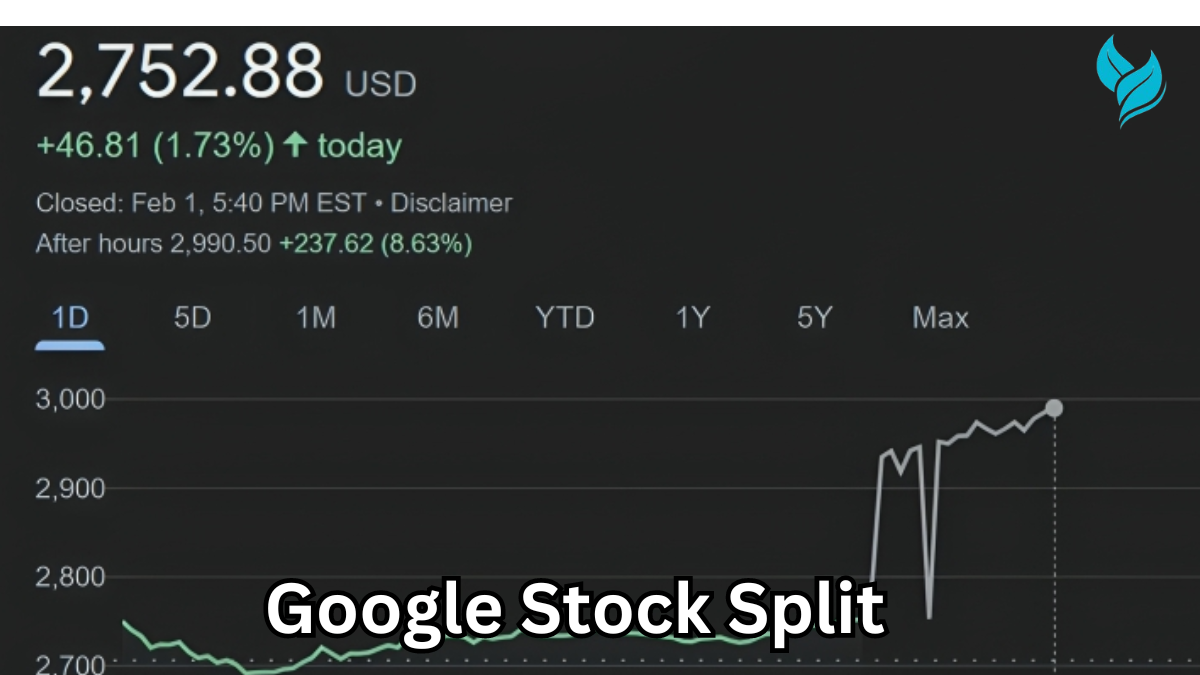

2022 Google Stock Split (20-for-1 Split)

In February 2022, Alphabet Inc. announced a major Google stock split: a 20-for-1 split, which took effect in July 2022. This means that for every share an investor owned before the split, they received 20 shares post-split. This was a forward stock split designed to make the high-priced stock more affordable for average investors.

Before the split, Alphabet’s shares were trading at over $2,000 each. Post-split, the price per share dropped significantly, making it easier for more investors to buy shares.

Why Did Google Decide to Split Its Stock?

There are several reasons why companies like Google (Alphabet Inc.) opt for stock splits:

Improving Accessibility for Retail Investors

One of the primary reasons for the Google stock split was to make its shares more accessible to individual investors. With Alphabet shares trading in the thousands, it was difficult for small retail investors to buy even a single share. The split dramatically lowered the price, allowing more people to invest in Google.

Increasing Liquidity

Lower-priced shares are generally easier to trade, which increases the stock’s liquidity. A more liquid stock is beneficial for both the company and its investors, as it ensures smoother transactions and less price volatility. By performing a Google stock split, Alphabet boosted trading volumes and made the stock more attractive to short-term traders and institutional investors alike.

Psychological Impact on Investors

Stock splits often have a positive psychological effect on investors. While the intrinsic value of the stock doesn’t change post-split, the perception of a lower price can create the illusion of affordability, encouraging more buying activity. In the case of the Google stock split, more investors were drawn to the stock post-split, driving higher demand.

Potential Inclusion in Indexes

Some stock indexes, like the Dow Jones Industrial Average, are price-weighted, meaning that higher-priced stocks carry more influence on the index’s overall performance. By splitting its stock and reducing its share price, Alphabet increased its chances of being included in indexes like the Dow, which could further drive demand.

Impact of the Google Stock Split on Investors

Share Quantity

For existing shareholders, the Google stock split did not alter the value of their holdings. Instead, it increased the number of shares they owned. If an investor had one share of Google before the 20-for-1 split, they ended up with 20 shares post-split, with each share being worth one-twentieth of the pre-split price.

Lower Share Price

One of the most immediate impacts of a stock split is the reduction in share price. Before the 2022 split, Alphabet’s stock price was over $2,000 per share. After the split, the price dropped to around $100 per share, making it easier for smaller investors to buy shares.

Increased Market Participation

The Google stock split opened the door for more investors to participate in the company’s growth. With a lower price per share, individuals who were previously priced out of owning Alphabet stock were now able to invest.

Tax Implications

It’s important to note that stock splits themselves do not trigger taxable events. The value of your holdings remains the same, but the number of shares you own increases. However, if you sell shares after the split, capital gains taxes will apply based on your purchase price.

Dividends

Alphabet does not currently pay dividends, so the stock split did not affect any dividend payouts. However, for companies that do pay dividends, the payout per share typically decreases after a split to reflect the increase in shares.

FAQs

1. What is a Google stock split?

A Google stock split is when Alphabet Inc. divides its existing shares into multiple shares to make them more accessible to investors. In 2022, Google executed a 20-for-1 stock split.

2. Why did Google split its stock?

Google split its stock to make shares more affordable for smaller investors, increase liquidity, and potentially position itself for inclusion in major stock indexes like the Dow Jones Industrial Average.

3. How does a stock split affect my investment?

A stock split increases the number of shares you own but does not change the overall value of your investment. For example, if you owned one share worth $2,000 before the 20-for-1 split, you would own 20 shares worth $100 each post-split.

4. Does Google pay dividends after the stock split?

Alphabet Inc. does not currently pay dividends, so the stock split had no impact on dividend payments.

5. Is a stock split good for investors?

While a stock split does not inherently make the stock more valuable, it can be beneficial for investors by increasing liquidity, making the stock more affordable, and potentially driving higher demand.

6. When was the most recent Google stock split?

The most recent Google stock split was a 20-for-1 split that took effect in July 2022.

Conclusion

The Google stock split was a significant event in the financial markets, designed to make Alphabet’s stock more accessible to retail investors and increase liquidity. For existing shareholders, the split provided additional shares without changing the overall value of their holdings, while new investors benefited from a lower entry price.

Understanding the mechanics and implications of a stock split can help investors make informed decisions. As Alphabet continues to grow, its stock remains an attractive option for both long-term investors and those looking for opportunities in the tech sector.

Whether you’re a seasoned investor or new to the market, keeping an eye on developments like the Google stock split can offer valuable insights into a company’s financial strategy and future growth potential.